Who Needs Renters Insurance?

Almost everyone renting a property needs renters insurance these days—primarily because landlords increasingly require it for lease approval and renewals. Beyond meeting lease requirements, this coverage protects you from liability claims and costly situations that can arise in your rental unit.

Renters insurance isn’t designed for specific types of renters—whether you’re renting a full house or a single room, or you’re a college student in a dormitory or a retiree living in senior housing, this coverage is for you if you’re renting.

Despite any lease requirements, you need this protection because accidents, damages, and liability claims can happen to anyone renting any type of property—regardless of your living arrangement or circumstances.

Key Points

- Renters insurance applies to all renters—no special type of renter needs it more than others

- Each roommate needs their own policy—coverage doesn’t automatically extend to others

- Family members and spouses typically share one policy, but unmarried partners may need to be added

- Skipping coverage means paying all repairs, claims, and losses out of pocket

What Type of People Need Renters Insurance?

There’s no special type of renter who needs this coverage more than others—anyone renting a property, apartment, room, or house needs renters insurance for liability protection and to potentially satisfy lease requirements.

Don’t fall into the trap of thinking this coverage only applies to certain renters in specific situations. Renters insurance isn’t reserved for particular living arrangements or circumstances—it’s essential protection for anyone who rents.

The deciding factor isn’t your living arrangement, family size, or what you own. If you’re renting a space to live in, you need this coverage regardless of categorical differences or personal circumstances.

Do I Need Renters Insurance If I Rent an Apartment or a Room?

Whether you’re renting a single room, basement apartment, or entire house, you need renters insurance. The type or size of your rental space doesn’t change your need for liability protection and coverage.

Your rental arrangement doesn’t make you immune to incidents, accidents, or liability claims. A fire, water damage, or guest injury can happen in any space regardless of square footage or rental type.

The protection you need stays the same whether you rent one room or an entire property, so focus on the coverage itself rather than the size or type of space you’re renting.

Does Each Roommate Need Their Own Renters Insurance Policy?

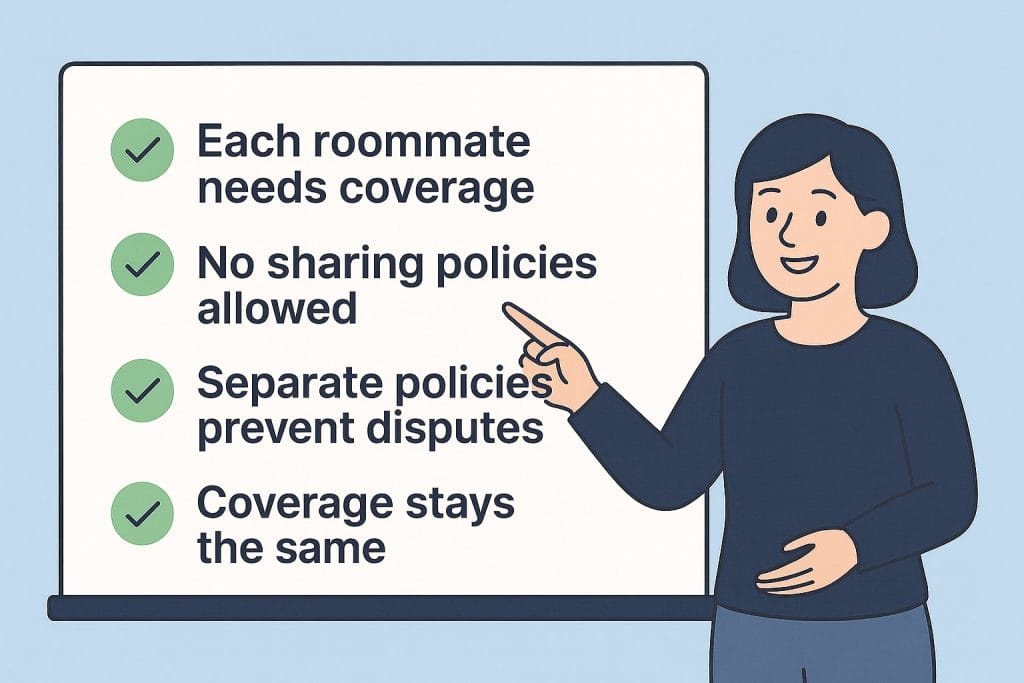

Renters insurance covers only the person named on the policy, so each roommate needs their own coverage to protect their belongings and liability.

This isn’t just a technicality—renters insurance policies don’t automatically cover roommates, even if you split rent equally. Only the named insured receives protection, meaning if your roommate faces a liability claim, your policy won’t provide coverage for their legal expenses or damages.

This creates a significant gap many don’t realize exists until filing a claim. Each person living in the rental needs to protect their own possessions and liability exposure separately—there’s no sharing when it comes to coverage.

If you’re in a roommate situation, remember that separate policies also prevent claim disputes down the line. When each person carries their own policy, claims get handled cleanly without confusion about who’s covered and what’s protected.

Do Family Members or Partners Need Separate Renters Insurance Policies?

Do Family Members or Partners Need Separate Renters Insurance Policies?

Family members and spouses living together are typically covered under one policy.

Most insurers automatically include immediate family members under a single policy, which means spouses and children receive protection without needing separate coverage, since policies treat the household as one unit.

Unmarried partners present a more complex situation that varies by insurer. Some companies automatically extend coverage to domestic partners, while others require adding them as named insureds.

If you’re living with a partner you’re not married to, check your policy wording specifically and ask your insurance agent to clarify coverage—adding them typically costs nothing or very little.

Some policies cover relatives by blood or marriage automatically, while others only cover your spouse and dependent children. Policies specify exactly who qualifies for coverage, and those specifications matter when filing claims.

Who Benefits Most from Renters Insurance?

Everyone who rents benefits from having renters insurance, but some people face greater vulnerability which makes this protection especially valuable for them.

Take lower-income renters, for example. People with limited incomes can’t easily absorb unexpected costs. If you’re living paycheck to paycheck, a sudden theft of your belongings or liability claim isn’t just an inconvenience—it’s a genuine financial burden that could take months to recover from.

People living in older buildings or properties with deferred maintenance also need this protection. These buildings often have aging plumbing, outdated electrical systems, or structural issues that increase the likelihood of water damage or fire—situations where your landlord might try to hold you responsible even when the real problem is building neglect.

Pet owners face serious liability risk regardless of their animal’s temperament or history. A single bite or property damage incident can trigger medical bills and legal costs that quickly climb into thousands of dollars you’d be responsible for paying.

While every renter benefits from coverage, these groups benefit tremendously because a modest monthly premium protects them from financial emergencies they’d struggle to handle on their own. The protection-to-cost ratio makes renters insurance especially valuable when you’re already facing financial constraints or heightened risk.

What Happens If I Skip Renters Insurance?

Skipping renters insurance means accepting full financial responsibility for any liability claims, repairs, or replacement costs that may arise. You’ll pay everything out of pocket without any coverage backing you up.

For most renters, the math doesn’t favor going without coverage. A typical policy costs roughly $20 monthly—about $240 annually—while a single incident could easily trigger thousands in unexpected expenses you’d need to cover entirely on your own.

If you still find the coverage isn’t worth the cost after considering these numbers, just understand the risks you’re accepting. Should something happen, there’s no safety net to fall back on.

FAQs

Does renters insurance cover theft outside the home (like from a car or hotel)?

In certain cases, yes. Renters insurance can cover theft of your personal belongings that occur outside your home, such as from your car or hotel room. It’s always best to check your specific policy conditions, as coverage details vary by insurer.

How much renters insurance do I need?

Enough to replace everything you own and protect against potential liability claims—typically $20,000-$30,000 in property coverage and $100,000 in liability. Create a home inventory listing all your possessions and their approximate values to determine your actual needs.

Many people underestimate what they own until they count everything. For liability, consider your risk exposure based on whether you have pets, host guests frequently, or live in high-traffic areas.

How much does renters insurance cost?

Typically $15-$25 per month, depending on your state, deductible, and coverage amount. Location significantly affects pricing—renters in areas with higher crime rates or natural disaster risks pay more.

Is renters insurance worth it for short-term renters?

It’s absolutely worth getting renters insurance even if you’re only renting for a short period. The risks—such as theft, damage, or liability—remain the same regardless of your length of stay, so protecting yourself is always important.

Keep in mind that many insurers allow month-to-month policies or easy cancellation, so you’re not locked into annual commitments.

Can I bundle renters insurance with auto insurance?

Yes, bundling often reduces both premiums significantly. Most insurance companies offer multi-policy discounts ranging from 5% to 25% when you bundle renters and auto coverage.

This approach also simplifies insurance management by keeping everything with one company and one billing cycle.

Bottom Line: Summary of What to Remember

These are the most crucial points to keep in mind as you move forward:

- Renters insurance isn’t just for certain types of renters—it applies to anyone renting any type of property, regardless of age, living situation, or belongings value.

- Each roommate needs their own policy. Coverage doesn’t automatically extend to roommates, even in shared living situations.

- Skipping coverage means accepting full financial responsibility for any damages, claims, or losses that occur—potentially costing thousands you’ll pay out of pocket.

Don’t forget: Renters insurance protects everyone who rents, but it’s especially critical for those in vulnerable situations—whether due to finances, housing conditions, or specific circumstances. One incident without coverage can create financial hardship lasting months or years.